Updates

PayFlex and Millennium Trust are now Inspira Financial

If you are enrolled in the 2024 University of Michigan Flexible Spending Account, you will receive an email from Inspira Financial regarding this change. View an example of the email you will receive. No action is required.

Visit the Inspira Financial homepage to learn more.

Please note:

- There will be no disruption with your PayFlex account

- Inspira will be the administrator for you account

- Your PayFlex login username and password will still work.

- If you have the PayFlex Mobile App, you will automatically be prompted to update it to Inspira Financial mobile app

- If you have a PayFlex debit card, it will remain active and you can continue to use if for your eligible health care expenses

- PayFlex branded cards for current members will still work through the expiration date found on the card

- Renewal or Lost or Stolen cards will be issued under Inspira

Third-Party Breach Affects PayFlex Data

In June 2023, Sovos Compliance, LLC (Sovos), a third-party vendor used by PayFlex, reported a data security incident. A small number of U-M current employees, former employees and retirees were affected. Although there is no indication of identity theft or fraud related to this event, tools and credit monitoring resources are being provided to those affected. A Sovos investigation concluded that the unauthorized disclosures included names, social security numbers, and last known addresses.

If you are affected by this breach, you will receive a letter from Sovos or Sovos Compliance, LLC to inform you of the following:

- Date(s) and scope of the event

- Resources for credit monitoring and identity restoration services

PayFlex is working with Sovos to assist those affected and address required notifications to state government agencies, consumer reporting agencies, and credit bureaus.

Contact the following for more information:

- Kroll (free credit monitoring) – enroll.krollmonitoring.com/create-account

- Sovos – (866) 373-7132, Monday - Friday from 9 a.m. to 6:30 p.m. Eastern Time

- Inspira Financial – (877) 343-1346, Monday - Friday from 8 a.m. to 6 a.m. Eastern Time

About Flexible Spending Accounts

Flexible Spending Accounts (FSAs) allow you to pay for out-of-pocket health care and dependent care expenses with pre-tax dollars. Your contributions are subtracted from your paycheck before federal, state and FICA taxes are calculated on your pay, so you save money on taxes. Contributions to FSAs do not reduce your pay for purposes of determining your life insurance, travel accident insurance, long-term disability or retirement benefits provided by the university.

An external vendor, Inspira Financial, will process claims for reimbursement.

U-M offers three kinds of FSAs:

- The Health Care FSA is used to pay for most out-of-pocket medical, vision, and dental care expenses for you and your eligible dependents.

- The Limited Purpose FSA covers eligible dental, orthodontic and vision expenses. It is only available to employees enrolled in the Consumer-Directed Health Plan (CDHP).

- The Dependent Care FSA is for eligible day care expenses for a dependent child under the age of 13, or elder care for a dependent adult, while you and your spouse work (or if your spouse is a full-time student or disabled).

You can enroll in one type of FSA or both. You contribute tax-free dollars to your FSA(s) through payroll deductions. You can claim amounts equal to your entire annual health care contribution from your Health Care Flexible Spending Account at any time during the year. To receive a reimbursement from your Dependent Care FSA, you must have enough funds in your account to cover the claim at the time you make the request for reimbursement.

Flexible Spending Account Limits

2024

- Health Care FSAs: You can contribute a minimum of $120 ($10 per month) up to a maximum of $3,050 per calendar year.

- Limited Purpose FSA: You can contribute a minimum of $120 ($10 per month) up to a maximum of $3,050 per calendar year.

- Dependent Care FSAs: You can contribute a minimum of $120 ($10 per month) up to $5,000 each calendar year. Highly compensated faculty and staff (family gross earnings in 2023 of $150,000 or more) can contribute $3,600 per year.

FSA Enrollment Forms and Documents

Download a form or complete an eForm to enroll in an FSA. Unlike other benefits, IRS rules do not allow FSA enrollments to carry over from year to year. You need to enroll in an FSA each year you wish to participate.

Access additional forms, information and documents.

FSA Books

- 2024 Flexible Spending Accounts (effective January 1 - December 31, 2024)

Inspira Card

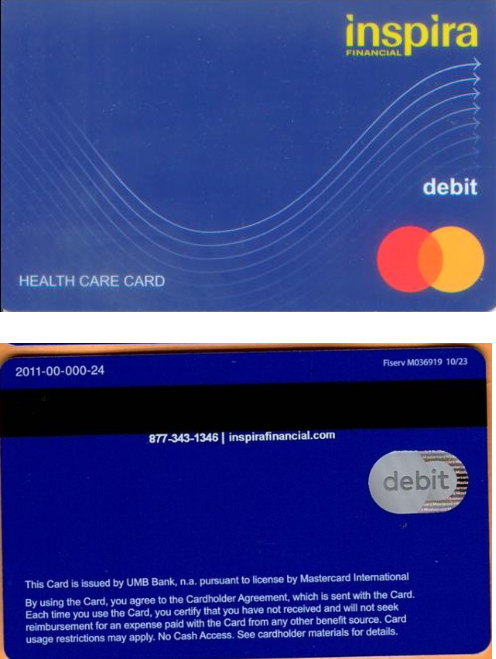

Inspira Financial will mail a debit card to new enrollees in a Health Care FSA to pay for eligible health care expenses. If you are only enrolled in a Dependent Care FSA, you will not receive a card. If you are enrolled in a Health Care FSA and did not receive a card, call Inspira Financial at 877-343-1346. Learn more about using your card.

Here is a sample of what the card looks like:

The plan year ends on December 31. A grace period allows you to incur eligible expenses up to March 15 of the following year.

IRS "Use It or Lose It" Rule

Contribute to an FSA only the amount you are reasonably sure you will spend annually and file all claims for reimbursement by the deadline.

In accordance with Internal Revenue Code and supporting treasury regulations, the university uses forfeited funds to pay administration costs of the of the FSA program. In the alternative, forfeitures may also be used by the university to fund employee benefits administration costs, education and benefit election tools, MHealthy coaching and health initiatives, the Emergency Hardship Program, and university scholarship funds.

Benefits of an FSA

Flexible Spending Accounts reduce your annual taxes. Here is an example of possible tax savings with an FSA.

| Annual Savings Example* | With an FSA | Without an FSA |

|---|---|---|

| If your annual taxable income is: | $28,000 | $28,000 |

| And you deposit this annual amount pretax into a Health Care Flexible Spending Account: | ($1,500) | $0 |

| Your taxable income is now: | $26,500 | $28,000 |

| Subtract federal and Social Security taxes: | ($9,447) | ($9,982) |

| Subtract after-tax dollars spent on medical expenses without an FSA: | $0 | ($1,500) |

| Your real spendable income is: | $17,053 | $16,518 |

| Your annual tax savings is: | $535 | $0 |

* Potential tax savings shown for demonstration only. Actual savings will vary based on your individual tax situation. Please consult a tax professional for more information.

Contact Inspira Financial

- For more information on the benefits of FSAs and how to use your accounts, visit the Inspira Financial website.

- Connect to a Inspira Financial customer service agent through the Live Chat feature:

- Once logged into the Inspira Financial member site, select Help & Support at the top of the screen.

- Select Contact Us.

- From the displayed page, click CHAT NOW.

- Agents are available to chat Monday - Friday, 8:00 a.m. - 6:00 p.m. (ET)

- Call Inspira Financial: (877) 343-1346

- Send claims to:

Inspira Financial

P.O. Box 8396

Omaha, NE 68108-0396