Saving for college has become one of the most important financial goals, like buying a home or saving for retirement. Start saving for your child’s future college education as soon as you can. Small contributions add up over time.

In an effort to meet the needs of all residents, the state of Michigan offers both a pre-paid plan and college savings plans. Each option offers a state of Michigan income tax deduction and tax deferred earning potential, as well as tax free withdrawals when funds are used for qualified educational expenses.

The Michigan Education Savings Program direct sold 529 college savings plan is managed by TIAA, Tuition Financing Incorporated. MESP was established in 2000, and TIAA has been the plan manager since inception.

Learn More About MESP and 529 Plans

- Visit the MESP website

- Watch a video about how to enroll in MESP

- Watch a video about 529 plans

- Download a 529 plan printable fact sheet with FAQs

Benefits of an MESP College Savings Account

- 100% tax-free growth for qualified withdrawals means more money for college

- Use at any accredited school in the U.S. or abroad

- Flexible investment choices

Live Webinars

Join MESP in a live webinar to learn more about the state of Michigan’s direct-sold 529 program. You can access the interactive session from your computer and connect with live presenters. RSVP today; instructions will be sent to you via email.

-

College Savings Workshop

Tuesday, May 27

noon - 1 p.m.

Learn more about Michigan's 529 education savings programs, including:

- The potential benefits of using 529s

- Where can I use my MESP savings?

- How does the Michigan income tax deduction work?

- How do I get started?

View the MESP Workplace Savings flyer for more details.

Michigan Achievement Webinars

High school students and families interested in learning more about the Michigan Achievement Scholarship are encouraged to attend informational webinars provided by Michigan Student Aid.

You will learn about the following:

- The NEW community college guarantee

- Michigan Achievement Scholarship eligibility requirements

- Michigan Achievement Scholarship award amounts

- Important action items for students and families

- Additional resources and program information

Check back in a few weeks for a schedule of upcoming Michigan Achievement webinars.

Closed captioning will be provided. If you need special accommodations, email [email protected] two business days prior to the webinar. Requests received after that timeline cannot be guaranteed, but every effort will be made to provide the accommodation requested.

Not able to attend? View a video of the Michigan Achievement Scholarship informational session.

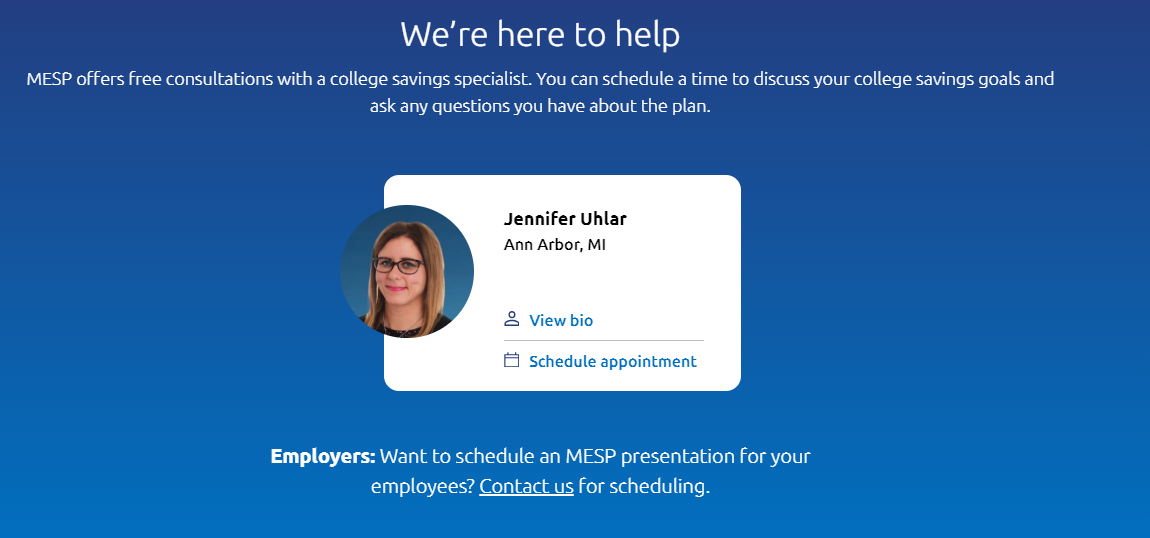

Schedule a Free Consultation

If you would like help or have additional questions, MESP offers free consultations with a college savings specialist. You can schedule a consultation to discuss your college savings goals and ask questions about the program. Request an appointment.

MESP Earns Top Rating for Third Straight Year

Morningstar analyzed 54 education savings plans in 2022. MESP was one of two to earn a “Gold” rating, and the plan was praised for its “excellent stewardship” and “well-designed, low-cost offerings.” Plans receiving “Gold” ratings are considered “industry standard setters” by Morningstar. For more information about Morningstar's overview of the Michigan Education Savings Program, visit the Morningstar website.

Past performance does not predict future results. A Morningstar Analyst Rating for a 529 college savings plan is not a credit or risk rating. Analyst ratings are subjective in nature and should not be used as the sole basis for investment decisions.